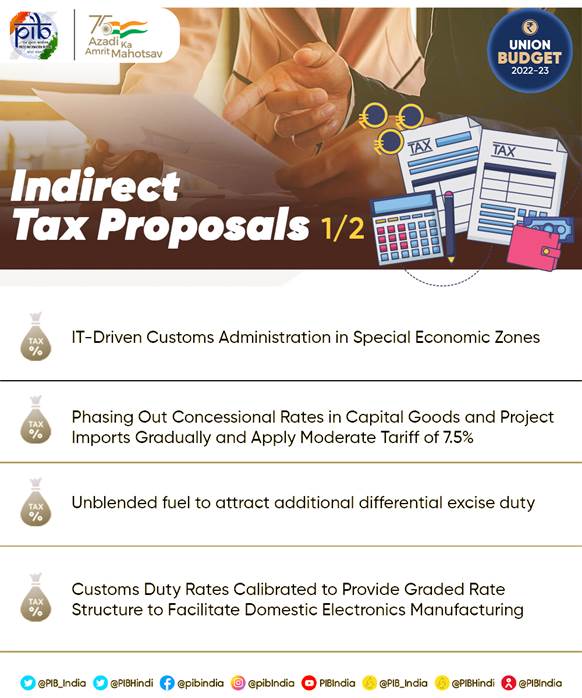

New Delhi, 01 February 2022: Customs administration of SEZs shall be fully IT driven announced the Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman while presenting the Union Budget 2022-23 in the Parliament today. She also said that the Customs National Portal will function with a focus on higher facilitation and with only risk based checks.

Capital Goods and Project Imports

The minister announced that the Government proposes to phase out the concessional rates in capital goods and project imports gradually and apply a moderate tariff of 7.5 per cent. She clarified that certain exemptions for advanced machineries that are not manufactured within the country shall continue. Further, she announced that the Government would introduce few exemptions in cases like specialised castings, ball screws and linear motion guide to encourage domestic manufacturing of capital goods.

She stated, “our experience suggests that reasonable tariffs are conducive to the growth of domestic industry and ‘Make in India’ without significantly impacting the cost of essential imports” and pointed out that several duty exemptions granted to capital goods in various sectors such as power, fertilisers, textiles among others have hindered the growth of the domestic capital goods industry. Similarly she said that project import duty concessions have also deprived the local producers of a level playing field in certain areas like coal mining, power generation among others.

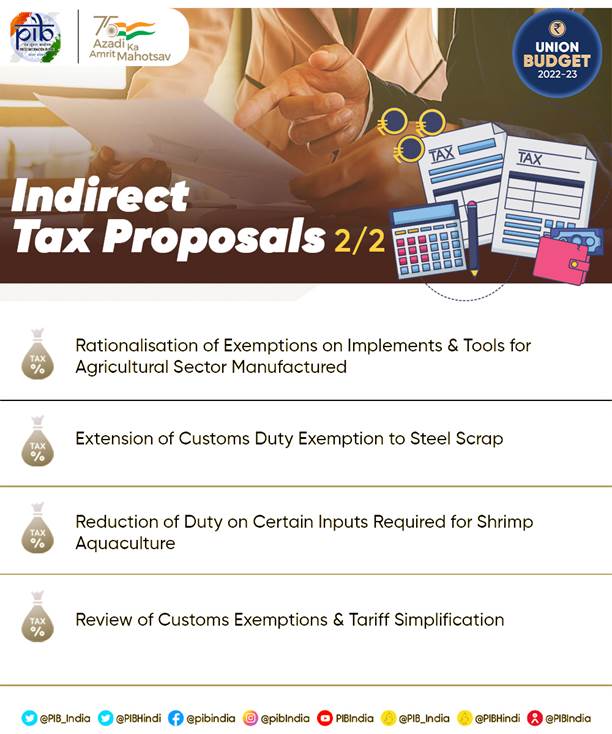

Review of Customs Exemptions and Tariff Simplification

Recalling that the Government has rationalised several customs duty exemptions in the last two budgets, Smt. Sitharaman said that after extensive consultations along with crowd sourcing the Government proposes to phase out more than 350 exemption entries. These include exemption on certain agricultural produce, chemicals, fabrics, medical devices, drugs among others. Further, she said that as a simplification measure, several concessional rates are being incorporated in the Customs Tariff Schedule itself instead of prescribing them through multiple notifications. This review would simplify customs rate and tariff structure particularly in sectors such as chemicals, textiles and metals, and minimise disputes. She added that removal of exemption on items which are or can be manufactured in India and providing concessional duties on raw material that go into manufacturing of intermediate products will go many a step forward in achieving our objective of ‘Make in India’ and ‘Atmanirbhar Bharat’.

The minister pointed out that customs reforms have played a very vital role in domestic capacity creation, providing level playing field to MSMEs, easing of raw material supply side constraints, enhancing ease of doing business and being an enabler to Government’s policy initiatives like PLIs and Phased Manufacturing Plans. In alignment with these objectives sector specific proposals are as follows:

Electronics

To facilitate domestic manufacturing of high growth electronic items, wearable and hearable devices, and electronic smart meters, Smt. Sitharaman announced that customs duty rates would be calibrated to provide for a graded rate structure. She also said that Duty concessions are also being given to parts of transformer of mobile phone chargers and camera lens of mobile camera module and certain other items.

Gems and Jewellery

The minister said that to give boost to the Gems and jewellery sector, customs duty on cut and polished diamonds and gemstones is being cut to 5 per cent, and simply sawn diamond to zero per cent. She also said that a simplified regulatory framework would be implemented by June 2022 to facilitate export of jewellery through e-commerce. Further, to disincentivise import of undervalued imitation jewellery, the Government proposes customs duty of at least Rs. 400 per Kg on imitation jewellery.

Chemicals

She also announced that to enhance domestic value addition, the Government proposes to reduce the customs duty on certain critical chemicals namely, methanol, acetic acid and heavy feed stocks for petroleum refining, while increasing the duty on sodium cyanide for which adequate domestic capacity exists.

Exports

The minister said that to incentivize exports, exemptions are being provided on items such as embellishment, trimming, fasteners, buttons, zipper, lining material, specified leather, furniture fittings and packaging boxes that may be needed by bonafide exporters of handicrafts, textiles and leather garments, leather footwear and other goods. She added that duty is also being reduced on certain inputs required for shrimp aquaculture to promote their exports.

Blending of Fuel

Smt. Sitharaman said that blending of fuel is a priority for the Government. To promote blending of fuel, the Government proposes to charge an additional differential excise duty of Rs. 2 per litre from 1st October 2022 on unblended fuel.

Progress on GST

Observing that “GST has been a landmark reform of Independent India showcasing the spirit of Cooperative Federalism”, Smt. Sitharaman stated that under the guidance and oversight of the GST Council, the administration was able to overcome challenges deftly and painstakingly. She added that the right balance between facilitation and enforcement has engendered significantly better compliance and said taxpayers deserve an applause for enthusiastically contributing to the cause by paying taxes. Further, the minister pointed out that the GST revenues are buoyant despite the pandemic and said that Indians can take pride in a fully IT driven and progressive GST regime that has fulfilled the cherished dream of India as one market-one tax. She also expressed with optimism that the Government aspires to tackle the remaining challenges in the coming year.

Smt. Sitharaman congratulated all Customs formations for their exceptional frontline work against COVID-19 pandemic and said the Customs administration has “reinvented” itself and “faceless customs has been fully established” through liberalized procedures and infusion of technology.